Health Savings Accounts

Find HSA Providers in Your Area

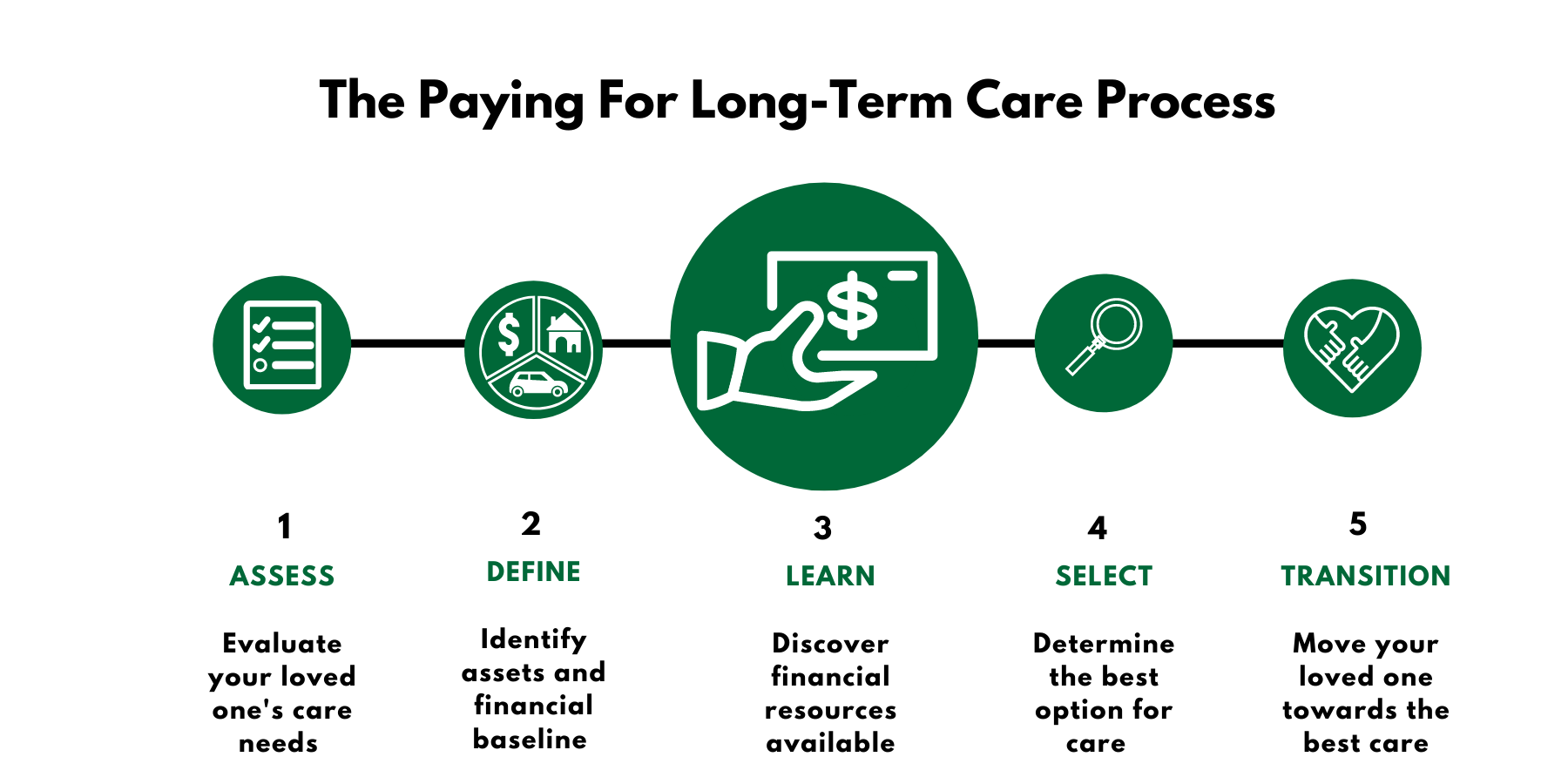

Step 3 – Learn: Health Savings Accounts

Health savings accounts (HSAs) are often overlooked opportunities to help cover the costs of long-term care with tax-free money. There are a few ways that you can make the most of your HSA assets to help cover medical and long-term care expenses.

It’s possible to tap your HSA – tax free – to pay for qualified long-term care insurance premiums. However, the IRS will only allow you to pay for long term care insurance with your HSA in certain situations. Insurance premiums are generally not treated as qualified medical expenses by the IRS, unless those premiums are for:

- Qualified long-term care insurance (most policies currently on the market are qualified)

- Health care continuation coverage

- Health care coverage while receiving unemployment compensation

- Medicare and other coverage for those who are 65 and older

HSA funds can also be used to pay for:

- COBRA coverage

- Health care coverage while unemployed

- Medicare

- Other health coverage once you or your loved one is age 65 or older

- Qualified long-term care services

Find HSA Providers in Your Area

Related Articles

Protect Your Assets From Nursing Home Costs

How to protect your assets from nursing home costs- a few financial tips and tricks. Knowing how to protect your assets from nursing home costs is crucial if you wish to pass on your hard-earned wealth to your loved ones. Long-term care can consume all your valuable...

How A Reverse Mortgage Can Pay For Eldercare Home Renovations

How can you use a reverse mortgage to help pay for senior care home modifications? In order to know how a reverse mortgage can help pay for home modifications that will accommodate your eldercare needs, it is important to understand what a reverse mortgage is and how...

How To Pay For Long-Term Care

Paying for long-term care may seem like an overwhelming feat. There are a number of ways to do it. The realization that you or your loved one needs long-term care can be overwhelming, especially when you consider the logistics and the cost. The cost of long-term care...

Additional Resources

You May Also Like

Discover the 2020 average cost of long-term care in your state

Get a free review of your long-term care policy with expert feedback and advice

Download a checklist for getting your house ready to sell at

Find HSA Providers in Your Area

Paying for Long-Term Care | All Rights Reserved | Privacy Policy | Terms and Conditions | Copyright © 2021