Veterans Benefits

Find a VA Accredited Representative to Help You Apply

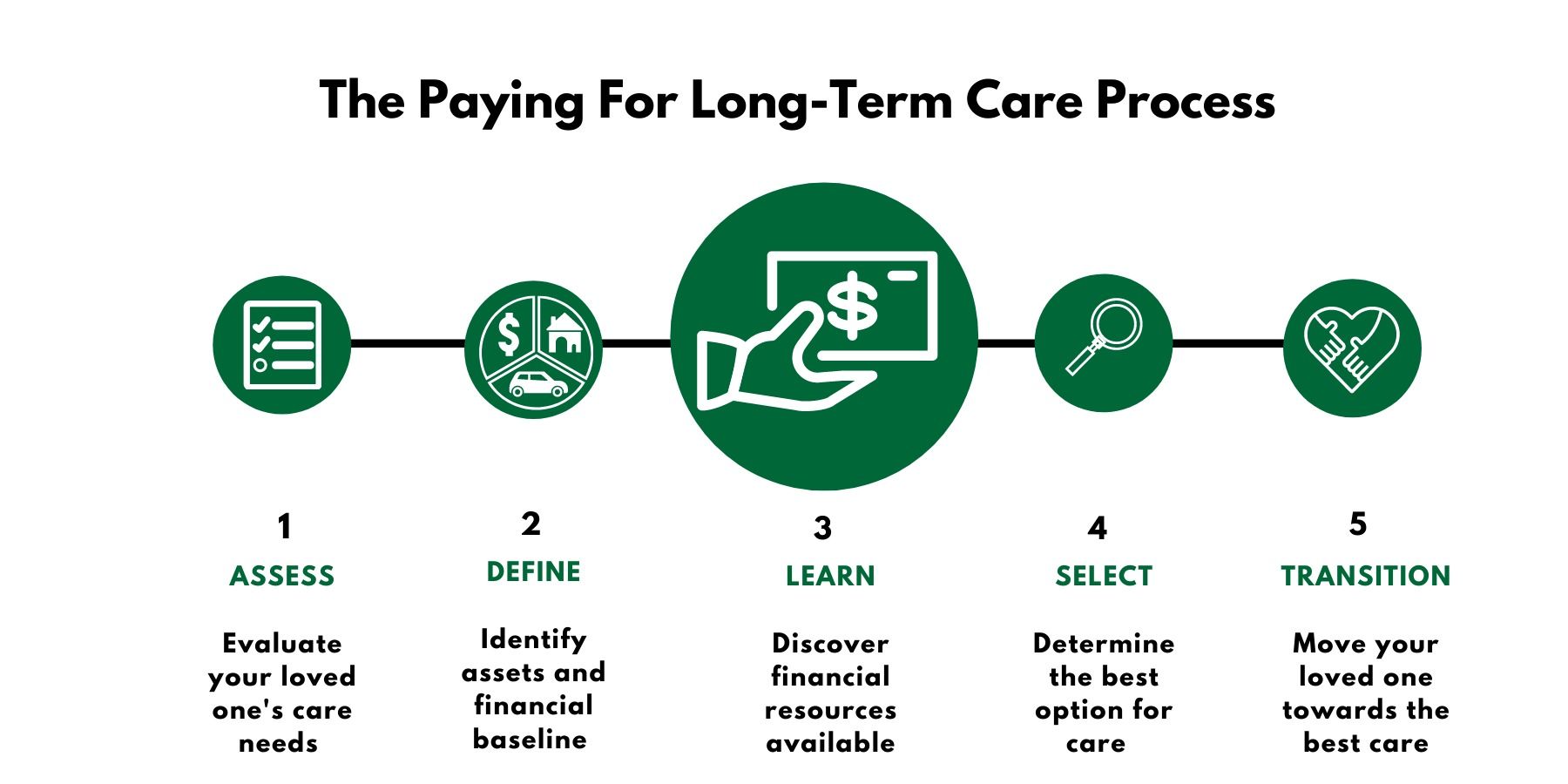

Step 3 – Learn: Veterans Benefits

Department of Veterans Affairs (VA) pensions provide a monthly benefit for wartime veterans (or their surviving spouses), which can be used as funding for care. Although there are 3 different types of pensions available for veterans and/or their spouses, most veterans’ families rely on the Aid and Attendance Pension to plan for long-term care. To qualify for the Aid and Attendance Pension, a veteran or his/her surviving spouse must meet certain eligibility requirements:

- Military Service – Must have served at least 90 days on active duty with at least one day during a period of war.

- Medical Requirement – Must have a medical condition that requires assistance from another person and meet at least one of four different conditions:

- Needing assistance with performing daily activities

- Being bedridden because of an illness

- Residing in a senior living facility

- Having extremely limited eyesight

- Income Requirement – The VA considers total income from all sources less

unreimbursed medical expenses, using this to calculate a monthly pension

award.

The application for benefits can be complex, but there are resources which can make the process easier.

Find a VA Accredited Representative to Help You Apply

Related Articles

By Ben Rao

•

March 26, 2021

Getting the in-home care you need for Alzheimer’s or dementia. As people age, a decline in their cognitive abilities is often evident. Alzheimer’s and dementia are two such conditions associated with aging. Today, several specialized care options are available for these conditions when you wish to help your loved one age at home.

By Ben Rao

•

March 12, 2021

How do I hire a long-term caregiver for my elderly parent? Frequently asked questions about hiring elder carers. With declining health and difficulty in performing activities of daily living (ADLs), elder care may become a necessity for your aging parents. One popular type of senior care is in-home care.