Selling Your House

Find Resources to Help You Sell Your House

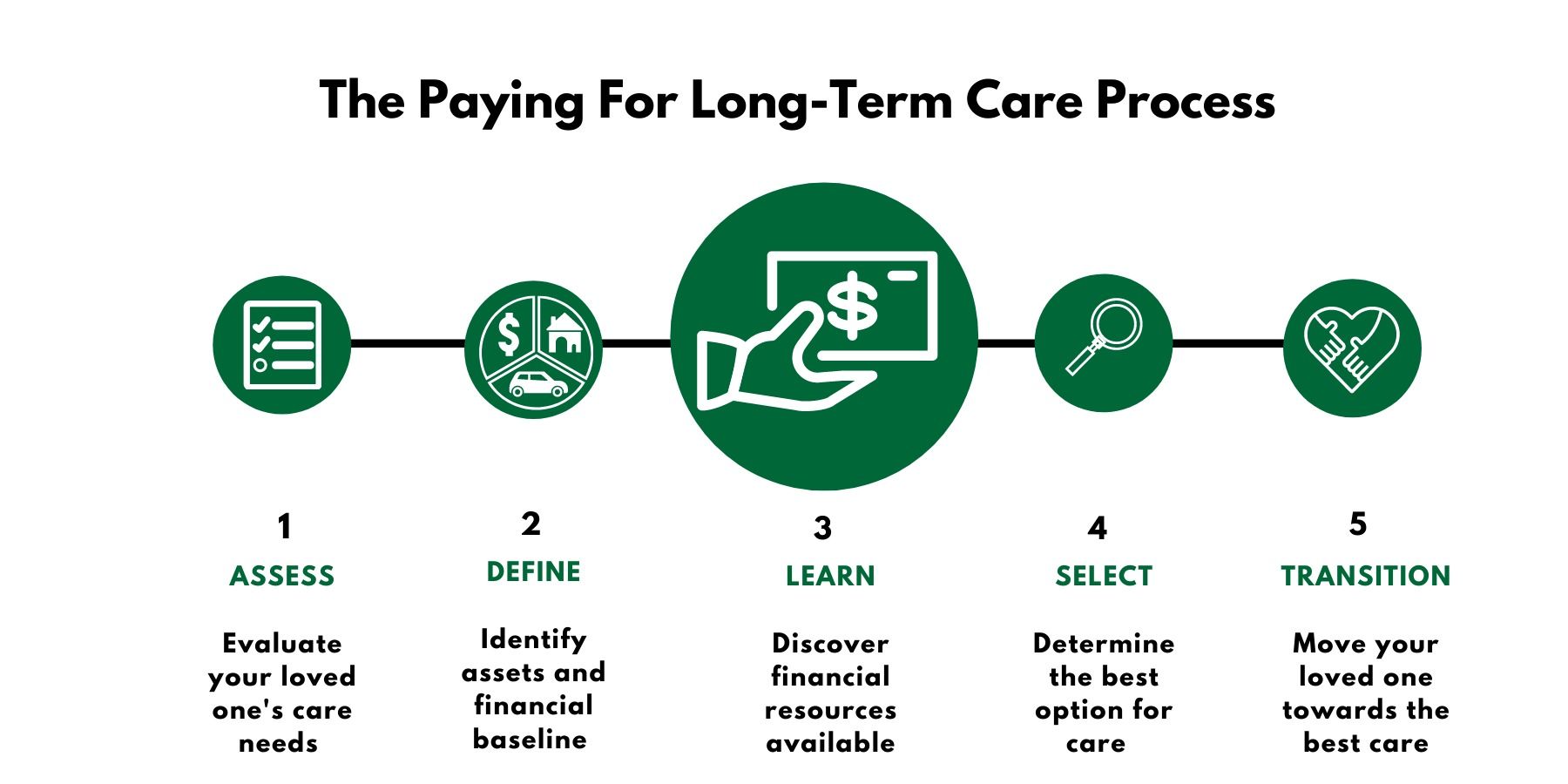

Step 3 – Learn: Selling the House

Selling the house – the family’s largest asset – is generally the first thing families will consider when determining how to pay for their loved one’s care. This is often the most emotional part of the transition journey, because the average American home contains well over 300,000 items of sentimental value. Families can spend months going through ‘the stuff’ before they even address the condition of the house itself.

Option 1:

Senior Transition “As-Is” Certified Cash Buyer

(14-30 Days)

This option can save families valuable time, money and resources since there’s no need to clear out the house or prepare it for the market. This option can also free up funds faster when compared to a traditional MLS listing sales cycle.

Option 2:

A Family Member Buys the House

(30-60 Days)

If all family members are in agreement about this and it won’t cause more problems than it solves, this could be a feasible option. A family member could also rent the house from the senior to generate cash flow. However, it’s important to keep in mind the increase in income could affect your loved one’s eligibility for Medicaid and veterans benefits.

Option 3

List the House with a Real Estate Agent

(90-180 Days)

Utilizing a traditional agent to list the house may be good if the house is in great condition. However, you need to factor in the additional cost of 6% commissions, closing cost, and ongoing costs like maintenance, insurance, taxes, utilities, and possible mortgage and interest payments.

By the time that a family is thinking about long-term care, their loved one’s health is usually declining and their need for care is becoming increasingly urgent. The sooner that you can get your loved one transitioned into care, the safer they’ll be. Waiting for the house to sell before taking that next step can cause delays in getting your loved one the care they need.

Your most important consideration should always be how soon your loved one needs to access care.

Find Resources to Help You Sell Your House

Related Articles